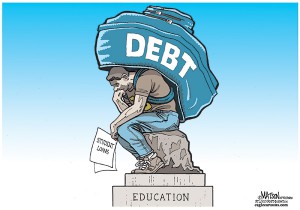

The Truth About Escaping Student Loans

With Americans everywhere still attempting to recover from the monetary trauma of our country’s most recent financial crisis, the idea of digging oneself out of financial indebtedness is likely to be on the forefront of our nation’s collective consciousness. We are, after all, a nation of debt holders. To the vast majority of us, the notion that the best way to achieve financial security is by borrowing money in order to build a solid credit history is not only non-paradoxical, but practical. Though now it seems the best way to monetary success is not through taking on more loans, but paying them off.

With Americans everywhere still attempting to recover from the monetary trauma of our country’s most recent financial crisis, the idea of digging oneself out of financial indebtedness is likely to be on the forefront of our nation’s collective consciousness. We are, after all, a nation of debt holders. To the vast majority of us, the notion that the best way to achieve financial security is by borrowing money in order to build a solid credit history is not only non-paradoxical, but practical. Though now it seems the best way to monetary success is not through taking on more loans, but paying them off.

Our current America, in this sense, appears to be on its head. Stranger still is that the most indebted in our country are no longer the mortgage holders, health care payers, or even small business holder. Nope, for the first time in American history the prize of being the country’s largest debt holders go to the poorest and most financially inexperienced among us: the students.

That’s right. Today, the total outstanding student loans in America racks in at $833 billion. That’s a B, as in “Big freakin’ amount of money.” No matter how you spin it, that’s a whole lot of green.

Student loans have long been considered to be a form of “good debt” in that it imparted to potential lenders that the holder of these types of loans are not only more responsible and intelligent then those who don’t hold this debt, but also more likely to actually repay loans on time simply because they completed college. When Lyndon Johnson sign the Higher Education Act to ensure every American had a shot at paying for college by way of federally guaranteed loans, student loans helped get kids their undergraduate degrees so they could then get a high paying job and live the American Dream. However, in light of today’s high unemployment rate, one would be hard pressed to find any unemployed college graduate to be living this ideal, let alone take on more loans after college life.

The reality is that more and more college graduates are finding themselves in situations where applying for new loans is impossible simply because taking on more debt wouldn’t be prudent without first being able to pay off their school loans first.

The reason is because Student loans are unique to other forms of debt. Unlike home or business loans, student loans cannot be discharged via bankruptcy unless the student can prove paying the loan would be an undue hardship. This is a high standard to prove because in order to qualify for it, a student would essentially have to show they’d be homeless if forced to pay their loans back.

Furthermore, student loans aren’t protected by state usury laws, the Truth in Lending Act, or the Fair Debt Collection Practices Act. They also have no statute of limitation on collection and cannot be refinanced. All of this means that student loans don’t have to have fair market interest rates and the holders of the debt can pretty much be hounded for the rest of their lives by collection agents until the loan is repaid.

The fun doesn’t stop there, because if a student defaults on their loan, their debt goes into collection which tacks on another 25 percent to the loan as part of the collection fee. About 25 percent of all student loans go into default. For those of you paying attention to the news, you might remember that during the subprime mortgage meltdown, defaults were at 25 percent, too. But unlike home loans, students cannot walk away from education loans. And for all of this madness, the government and SallieMae walk away with billions in profits. It’s win-win for everyone but the students.

This all must sound very scary and disheartening, right? Well, it is. However, like any good lawyer will tell you, there’s always a way out. Here are some tips on how to sidestep or at least soften the trap of student loans:

1) Find Scholarships

There are an incredible amount of people and organizations out there who want to give students money for school. Seek them out and apply, apply, apply for those scholarships.

2) Get A Job While You’re In School

Paying for school ain’t easy. Working while you’re going to class can help you earn a lot of money to start paying back your loans faster or take less of them.

3) Save Money And Live Within Your Means

If you’re planning on going to college, then you have to plan for it in advance. It’s a team effort on the part of students and parents.

Unfortunately, escaping the nightmare of student loans is mostly done by preventative measures. If you’re already loaded with student loans and can’t make the payments, there isn’t much you can do except maybe find an attorney to help you make a case that they’re really causing you undue hardship. It sucks, but there aren’t that many options.

Oh, and don’t say you heard it from me, but there is some research suggesting college may very well be a joke after all.

Comments