Red Team vs. Blue Team: Minimum Wage

Today’s article is a special two for one: two of our writers debate the merits of raising the minimum wage. Who do you think makes the most convincing argument?

Should the Federal Minimum Wage Rise?

by Alexis Watts

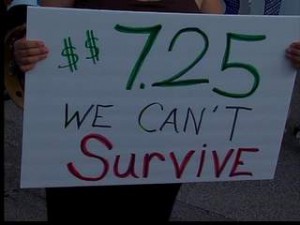

Recently, presidential candidates have discussed raising the Federal Minimum Wage, which is currently set at $7.25 an hour. Bernie Sanders advocates a minimum wage of $15 an hour, which is more than double the figure. Hillary Clinton argues that wages should gradually be raised to $12 an hour. Conservative candidates do not generally favor such high wage hikes, and this may be an issue for debate in the 2016 election.

The US currently has one of the lowest minimum wages of any high-income country. It has had a higher minimum wage in the past. In 1968, the minimum wage was $1.60, the equivalent of $10.34 an hour in current dollars. The US has also had lower minimum wages; in 1938, for example, the minimum wage was 25 cents, the equivalent of only $3.98 today.

So, should the national minimum wage be raised?

What is the Federal Minimum Wage, and who benefits from it?

The Federal Minimum Wage was originally part of the Fair Labor Standards Act (FLSA), passed in 1937. This act also regulated how many hours employees could work without receiving overtime pay. The federal government is authorized to set a minimum wage and make hours regulations because the Constitution gives it broad power to regulate many aspects of commerce in the United States. FLSA benefits many low-wage workers who are paid by the hour. While some characterize these workers as teenagers with no real responsibilities, statistics show that 89% of those who would benefit from a national raise are workers over the age of 20.

There are some exceptions to FLSA. Employees who receive tips or work on commission (such as waiters) receive a lower base wage, but employers must make up the difference if their total pay falls below a certain hourly minimum. Domestic and agricultural workers do not benefit from these minimum wage protections. One notable criticism of FLSA is that it leaves out these important workers, who are often from minority groups.

What about State and Local Minimum Wages?

29 states have raised their minimum wage to above $7.25 an hour. Some cities have raised their wages even higher. Berkeley, CA is now contemplating a minimum of $19 an hour. Seattle has already raised its minimum wage to $15 an hour. These high local wages may reflect unique economic conditions. In both the Bay Area and Seattle, the price of rent has been driven higher by an influx of highly paid technology industry employees. However, these cities still need hourly workers like clerks an baristas; they are often the backbone of a rich local cultural scene.

The Minimum Wage Must Properly Reflect Current Economic Needs

In the United States, the minimum wage makes it difficult to afford shelter and other essentials. Purchasing power varies widely from place to place; a dollar buys more housing, food, and other essentials in many rural areas than it would in a major city. However, the National Low-Income Housing Coalition recently issued a study showing that these regional differences still do not allow any minimum wage workers much breathing room. Most financial planners suggest that no more than 30% of a worker’s income go to housing. However, there is no state in which average minimum-wage workers can secure housing using only that portion of their income. An average two-bedroom apartment for a small family would now require a full-time wage of $12.65 an hour in Arkansas and a whopping $28.04 in Washington, D.C. Many low-wage workers have little ability to save or to buy non-essential goods.

While some argue that the minimum wage causes inflation, the reality is that inflation also devalues the minimum wage. The minimum wage does not automatically increase as the price of basic food or housing rises, leaving many individuals who provide important services without the means to earn a living.

If the Minimum Wage is Raised Gradually, it Will Not Increase Unemployment

When the minimum wage is raised, it redistributes some of the country’s entire income from the top (where it is often saved or invested) to the bottom (where it is often spent). Households in the bottom 20% make their income mostly through wages and employment-based tax incentives, and they experience an increase in discretionary income when wages rise. The money these households spend flows into the economy and may allow employers to create new jobs, rather than decrease their staff.

A Department of Labor survey recently showed that 3 out of 5 small business owners support a gradual increase in the minimum wage. This type of an increase would make it possible for business to operate without laying off employees. Department of Labor data also shows that there is no negative effect on unemployment when the minimum wage is raised.

Experiments like the minimum wage hike in Seattle may help to clarify what happens to a local economy when much higher wages are introduced. If the wage increase creates jobs and helps to eliminate poverty, it may prove detractors wrong.

_________________________________________________________________________________________________________

Arguments Against Raising the Federal Minimum Wage

by Sarah K. Lee

Is raising the federal minimum wage all it’s cracked up to be? Although recent presidential candidates have taken a stance for raising the minimum wage in support of more sustainable wages for low-income earners, there are a number of economists who widely disagree. Many economists claim that raising the minimum wage would in fact be detrimental to the economy and the low-income earners such advocates seek to protect. Economists predict raising the minimum wage would result in a steep decline in minimum wage jobs, higher consumer prices for goods, and less entry-level positions for less experienced workers–all of which would negatively impact low-income communities the most.

Increased Unemployment

A number of studies have shown raising the minimum wage results in a loss of jobs due to employers being unable to hire as many minimum wage employees as they would have been able to at lower wages. The Congressional Budget Office predicts a rise in minimum wage from $7.25 to $10.10 would result in a loss of 500,000 jobs across the nation. Supporting that prediction, a study showed the incremental minimum wage increases between 2006 and 2012 resulted in an overall decrease in the national employment-population ratio by 0.7 percent, equating to a loss of

approximately 1.4 million jobs. Economists argue inflating the minimum wage would actually do more harm than help to low-income communities, those who are purportedly meant to benefit from such a raise.

Higher Consumer Prices

Economists argue hiking the minimum wage could drive businesses to charge more for goods in order to make up for the additional labor costs. This would be particularly detrimental in low-cost, low-wage states where such an increase in prices would affect poor consumers the most. Again, economists argue such an outcome would negatively impact the very target group a raise in the minimum wage seeks to help.

Fewer Positions for Entry-Level Workers

A higher minimum wage could also result in more experienced workers feeling less compelled to move on to higher level positions because the pay at a minimum wage job is adequate. Such a scenario would be bad for less experienced workers, shutting them out from potential entry-level positions. These less experienced workers are primarily made up of teenagers, immigrants, and low-income populations–many who lack the skills to obtain any other type of employment and rely on minimum wage positions to help escalate them to higher paying positions. Economists argue a higher minimum wage could throw off the balance of employment dynamics.

Alternative to Raising the Minimum Wage? Raising the Earned Income Tax Credit (EITC)

Many who oppose raising the minimum wage are not against it for malicious reasons, but rather believe low-income populations can be aided through alternative means without disrupting employment rates. One of the most popular proposals has been to raise the Federal Earned Income Tax Credit (EITC). The EITC is a refundable tax credit calculated based on a recipient’s income and number of children. By increasing the EITC, more money would be afforded to those who are not making enough on wages alone. Advocates of this proposal maintain this change would provide real assistance to those who truly need it, the low-income population, and would not adversely affect employment rates or consumer prices.

Comments