Where There’s a Will, There’s a Way?

According to the U.S. Census Bureau, by 2030, about 20% of the U.S. population will be age 65 or older and by 2050, this aging segment of the U.S. will represent 88.5 Million people versus the 38.7 Million in 2008. The increasing age of the Baby Boomer population comes with a significant transfer of wealth either through wills, trusts or through state mandated intestacy laws. And, it raises an issue concerning how prepared Americans are in developing their estate plans, whether their estate is valued in the millions or in the thousands.

Contributing to this significant transfer of assets is an increase in the number of will contests being brought today, particularly as it relates to step-families. Children of these families are rapidly learning that the second (or third) spouse often has significant if not greater rights than the children; intestacy shares can range from 1/3rd to as much as ½ of the decedent’s estate when there is no will. (Before Your Parent’s Say ‘I Do’ Again)

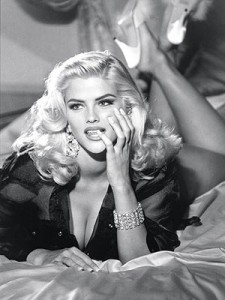

Even when there is a will, sometimes a new spouse will change not only the family dynamics but also the dynamics of the will or family trust. Most Americans are familiar with Anna Nicole Smith’s short-lived marriage and protracted court battles that continue even after her death. (Daughter to Inherit Mother’s Estate ). Anna’s litigation, however, is not atypical although most people’s estate assets are significantly less than the Marshall fortune.

Even when there is a will, sometimes a new spouse will change not only the family dynamics but also the dynamics of the will or family trust. Most Americans are familiar with Anna Nicole Smith’s short-lived marriage and protracted court battles that continue even after her death. (Daughter to Inherit Mother’s Estate ). Anna’s litigation, however, is not atypical although most people’s estate assets are significantly less than the Marshall fortune.

In fact, some children are proactively approaching their parents about their estate plans before their parents die. SmartMoney.com profiles Neil Finkel whose 80+ year-old father placed a large percent of his multi-million dollar estate into a trust for his son. However, Finkel’s Dad married a woman 30 years his junior. Amy, the new spouse, and Neil subsequently waged a 2-year court battle over the father’s dwindling assets which were being eroded by the spending habits of the new wife. Although the case was settled, it’s unlikely that the rift in the family will be healed and it could erupt again after Dad Finkel’s death. (Before Your Parent’s Say ‘I Do’ Again)

During the past five years, tens of thousands of people have used LegalMatch to find an attorney to represent them in filing a lawsuit to contest a will or to defend the estate against a will contest. Not surprisingly, many of the most popular states for will contests have a high concentration of residents age 65+. Plus, this top 10 state list comprises over 55% of LegalMatch’s will contest customers:

| Rank | Top Ten States Where LegalMatch Customers Sought Will Contest Lawyers |

| 1 | California |

| 2 | Texas |

| 3 | Florida |

| 4 | New York |

| 5 | Illinois |

| 6 | Pennsylvania |

| 7 | Ohio |

| 8 | Georgia |

| 9 | Virginia |

| 10 | North Carolina |

Your will or trust will have lasting implications on your heirs after your death, particularly in those families where there are step-children or multiple spouses. Probate litigation is generally protracted and can tear families asunder. Developing a proactive estate plan, even if your estate assets are small, should help to reduce family tension after your death. However your estate plan is crafted, you will be communicating a strong message to your family. The properly drafted will can stand the tests of probate court and ensure that your intent is followed after death.

Comments

I couldn’t agree more- one can only hope that the upcoming hearing in the onging Marshal v. Marshal saga will draw additional attention to this important issue. more importantly, I hope that the 9th Circuit rules, as they should, in favor of a person’s right to determine how their money should be allocated when they die.